Invoices generated post GST roll out can now be uploaded on GSTN portal

Updated: Jul 25, 2017 07:31:34am

Invoices generated post GST roll out can now be uploaded on GSTN portal

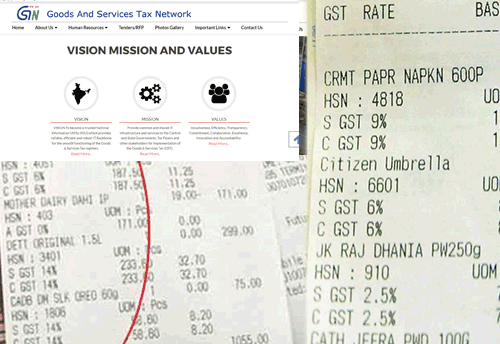

New Delhi, July 25 (KNN) Sale and purchase invoices of businesses generated post Goods & Services Tax (GST) roll out from July 1, 2017, can now be uploaded on GSTN portal.

The uploaded invoice data can be saved at the portal and the GST system operated by GSTN will auto populate the invoice data of the respective buyers, the company said in a statement.

The GST kicked in from July 1 and so far, the Goods and Services network has been facilitating registration of businesses.

“If the taxpayer has limited number of invoices, he can directly enter the details at the GST portal. However, this would not be practicable if the number of invoices is in hundreds or thousands,” it said.

It added that to help such taxpayers, GSTN has developed a tool which can be downloaded from the portal and installed on the taxpayer’s computer to prepare the return in GSTR-1 format at one’s ease in an offline mode without connecting to Internet.

“The GSTR-1 software and the offline java tool have been elaborately tested. The portal has started accepting invoice uploads into GSTR-1 from July 24. Now taxpayers can prepare GSTR-1 at their convenience on their own computer and upload the data to the Portal easily within a matter of minutes using the offline tool,” Navin Kumar, Chairman, GSTN said.

Loading...

Loading...