In some items where it appears tax rate has gone up, earlier they had embedded taxes that weren’t visible: Jitendra Singh

Updated: Jun 20, 2017 06:23:51am

In some items where it appears tax rate has gone up, earlier they had embedded taxes that weren’t visible: Jitendra Singh

New Delhi, June 20 (KNN) In case of some items, where visibly it appears that the tax rate has gone higher after GST, the matter of the fact is that earlier, these items had embedded taxes which were not visible even though the overall tax range amounted almost to the same, explained Dr Jitendra Singh, DoNER Minister.

On the other hand, there are also certain goods where GST imposes ‘zero’ tax, he added.

Dr Singh has said that GST will bring down tax on several goods and contrary to a perception held in certain quarters, the rollout of GST from 1st of July will bring a huge relief to the poor and lower middle class by resulting in a tax rate lower than the present tax rate.

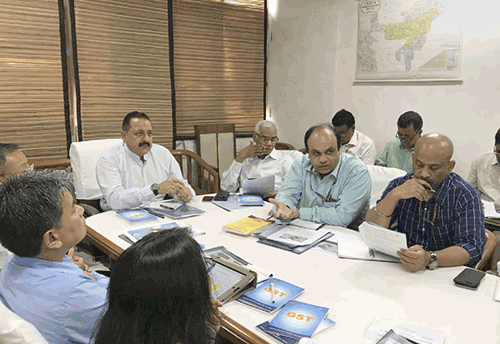

He was addressing a meeting to discuss the various aspects of GST rollout with the officials of the Ministry of DoNER and Delhi-based Resident Commissioners of eight North-Eastern States.

Dr Singh disclosed that a wide range of items including milk powder, curd, lassi, buttermilk, cheese, spices, tea, wheat, rice, flower, soybean oil, mustard oil, palmyra jaggery, mineral water, ice, coal, domestic LPG, tooth paste/tooth powder, soap as well as medical items like Insulin, X-ray films and spectacle lenses/glasses will actually have a lower tax rate after July 1st, following the GST roll-out as compared to the tax which is being currently imposed on these items.

Taking cognizance of the Internet-connectivity issues in Northeast, Singh said that a number of easier options are being worked out and reminded that the Internet connectivity is required only at the time of registration or logging-in.

For the convenience of the traders and others, during the initial transition period, he said, GST will be filed for first two months up to 20th August 2017, thereafter again by 20th September 2017 and thereafter, eventually every month as per norm. Meanwhile, the new registration will open from 25th June, he informed.

He also disclosed that a 2-day training programme for the Northeast officials is being conducted on regular basis at Shillong and on similar lines, an identical programme like is also being currently carried out at Faridabad.

The officials who get well versed in GST and its rollout procedure, he said, should in turn function as resource persons and collaborate with the GST Commissioner offices spread all over the country including in Northeast in conducting awareness and assistance programmes for businessmen, traders, members of the industry and other stakeholders.

Referring to the exemption limit of up to Rs.10 lakh to Northeast, the Minister recalled that earlier it was much lesser in some of the North-Eastern States like, for example, Rs. 3 lakh for Sikkim, Rs. 2 lakh for Arunachal Pradesh and Rs.6 lakh for Assam.

Reiterating the importance of GST rollout, for the middle class and the poor, Singh said, it will also eliminate the role of toll post and put a check on bribery and corruption.

Loading...

Loading...