FISME takes up key recommendations from MSME sector to Finance Minister for Budget

Plagued with various issues related to availability of timely credit, Non-Performing Assets (NPAs) and limited access to markets, the Federation of Indian Micro and Small & Medium Enterprises (FISME), the apex body for MSME associations in the country, proposed few suggestions to Finance Ministry including creation of trade portal, inclusion of all listed companies on TREDs platform to incorporate in upcoming budget 2019.

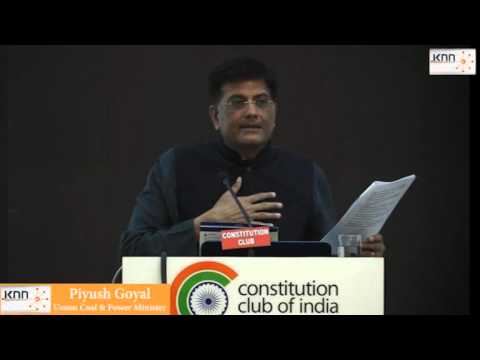

Union Finance Minister Nirmala Sitharaman on Tuesday held a pre-budget meeting with industry associations in North Block. The Ministry had sought suggestions from the trade bodies and industry associations ahead of the budget on July 5, 2019.

Speaking with KNN India on the sidelines the meeting, President of FISME Animesh Saxena said “Since MSME sector has been undergoing a prolonged period of stress due to liquidity crunch in the market, so we suggested the Ministry that every listed company should be on TREDs platform so that liquidity can be increased."

He said “On TREDS platform, any company which is 500 crore and above they have to publish their data and lot of finance companies they pay to the vendor and take money from them, so we suggested the ministry this limit should be removed.”

Further, he said “We suggested the Ministry to create a trade portal, something like credit bureau under the government control to know the financial health of companies.

This move will not only help in taking the good decisions but NPAs can also be studied from there, he added.

On asking what more needs to be done to foster more inclusive growth of MSMEs, Saxena said MSMEs considered as operational creditor. There should be one sub category where they should be given preference. In addition, government should incentivize job creation.

On availability of credit, he stated “Because NBFCs are in bad shape, there is liquidity crunch. So, we requested the government that NBFCs should be saved, because if they die down the crunch will further increase."

COMMENTS

Be first to give your comments.