MSME exporters want govt to consider “errors due to technical glitch” due to initial confusion while claiming IGST refund

New Delhi, Nov 2 (KNN) The MSME exporters of the country, who have a huge contribution towards the country’s GDP, are disappointed that they are being made to let go the heavy IGST refund amount due to lack of assured handhold support during the transition period from indirect tax regime to the very new Goods & Services Tax (GST) regime.

In an interview with KNN India, Pankaj Bansal, Director, TMA International cried that the exporters first pay tax and then get refunds.

“And now when our crores and crores of amount is stuck in this, we are being denied the duty drawback. And all this because of errors made due to technical glitch during the transition period,” Bansal, an exporter and also Treasurer of the Federation of Indian Micro and Small & Medium Enterprises (FISME) said.

He said hundreds of exporters are facing due to this. And of each exporters out of the 50 he spoke to, amount of Rs 10 lakh to Rs 1 crore is stuck which has severely blocked their capital.

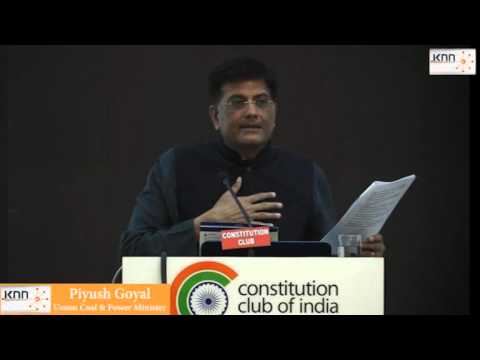

Watch his full interview

(KNN India)

COMMENTS

Be first to give your comments.